nj tax sale certificate

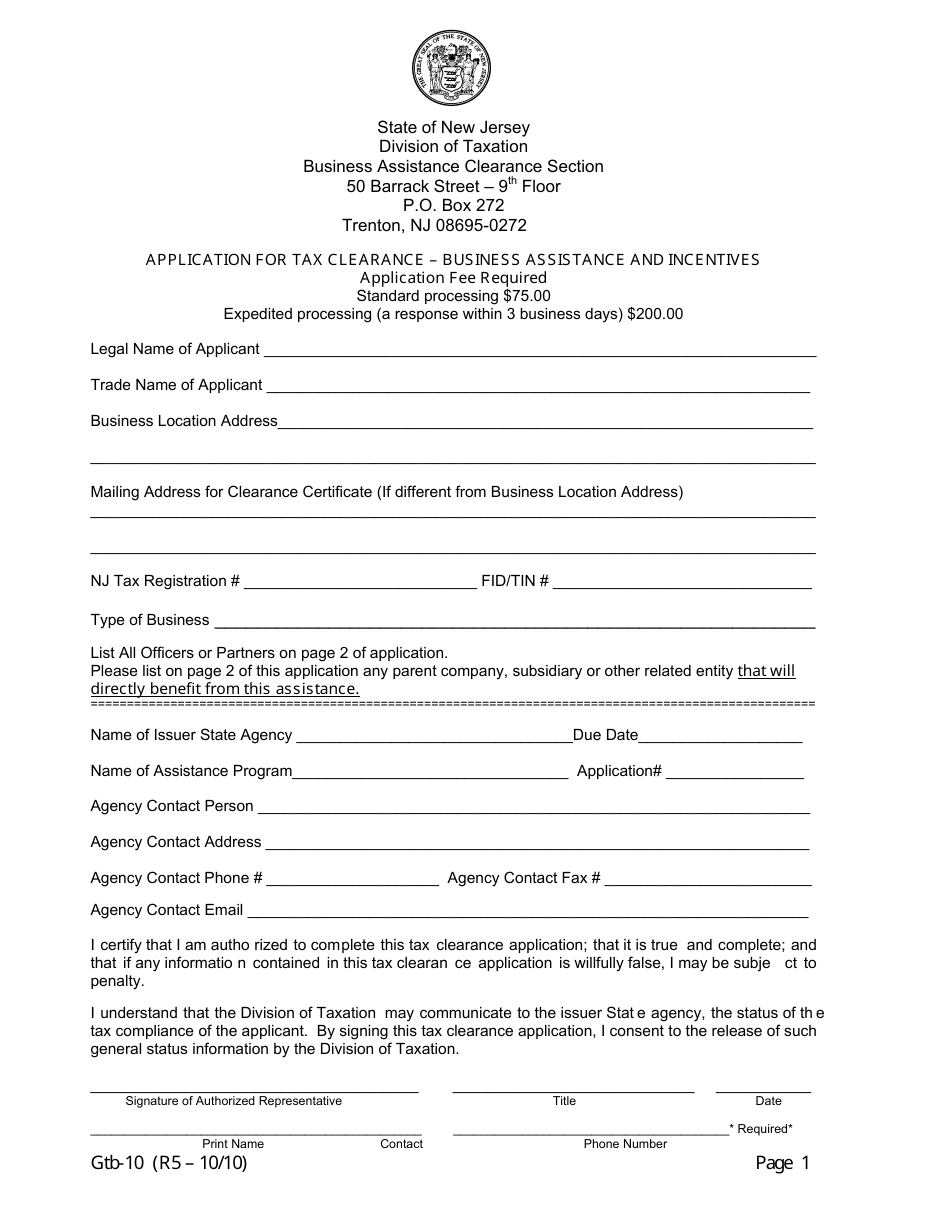

Once you have that you are eligible to issue a resale certificate. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business.

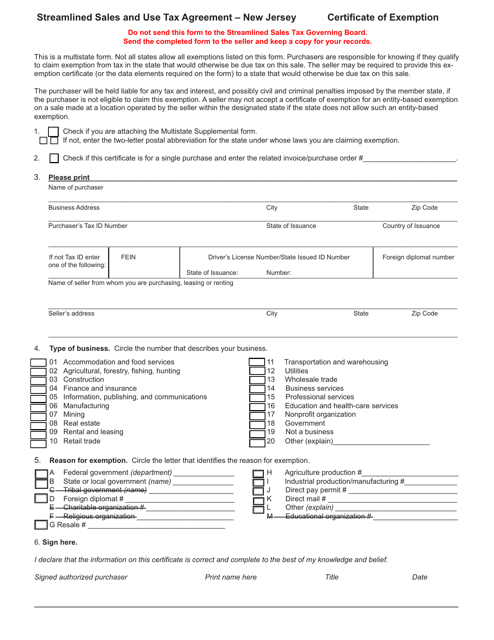

New Jersey Streamline Sales Use Tax Agreement Certificate Of Exemption Download Fillable Pdf Templateroller

New Jersey Sales and Use.

. New Brunswick NJ 08901. Some municipalities include an additional 6 year end penalty on tax lien certificates. Monday - Friday.

As with any governmental activity involving property rights the process is not simple. Items for resale you will be sent a New Jersey Certificate of Authority Form -1 for Sales CA Tax. Purchasers of tax sale certificates liens.

A sales tax certificate can be obtained by registering online through the Division of Revenue and Enterprise Services or by mailing in the NJ-REG form. The tax rate was reduced from 7 to 6875 in 2017. In New Jersey property taxes are a continuous lien on the real estate in the full annual amount as of the 1st of the year.

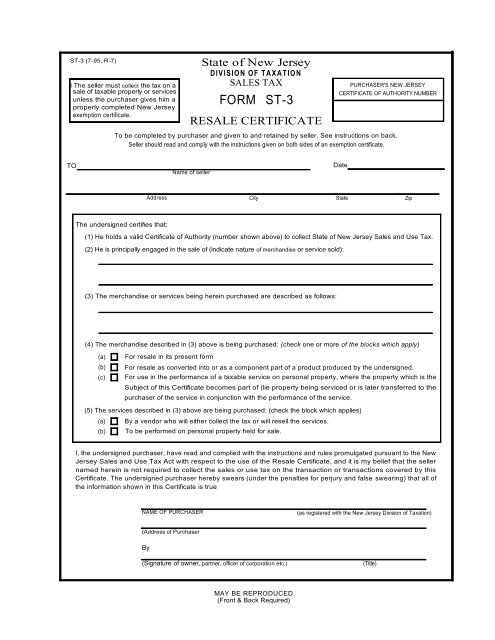

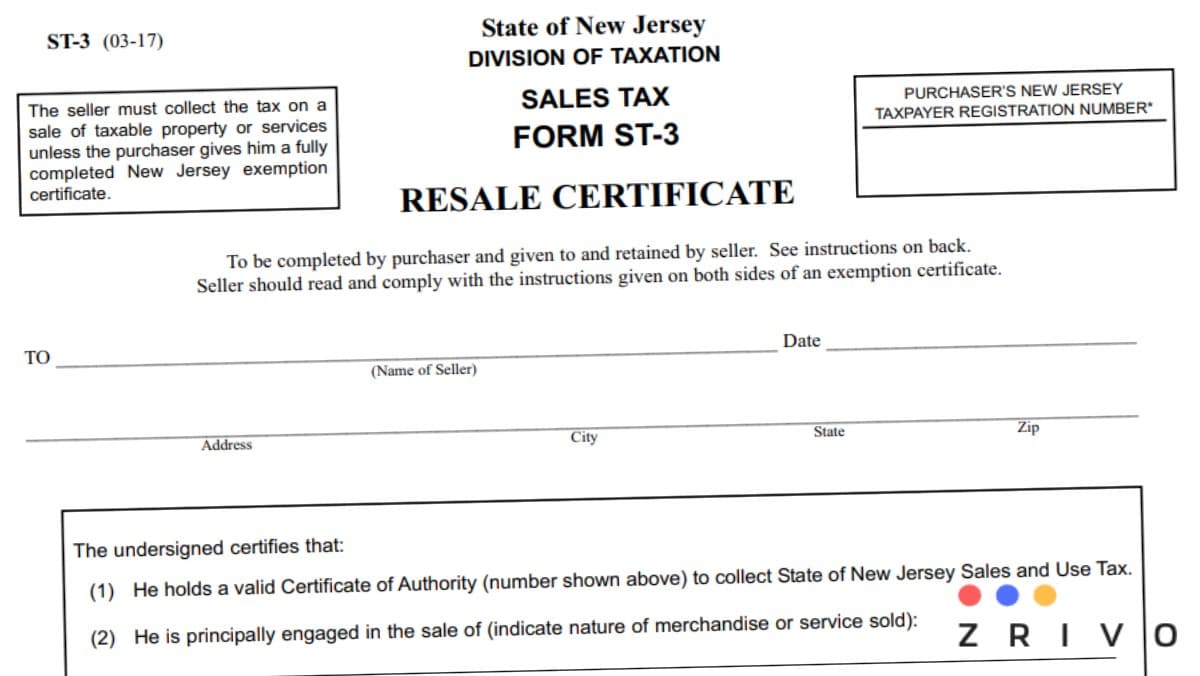

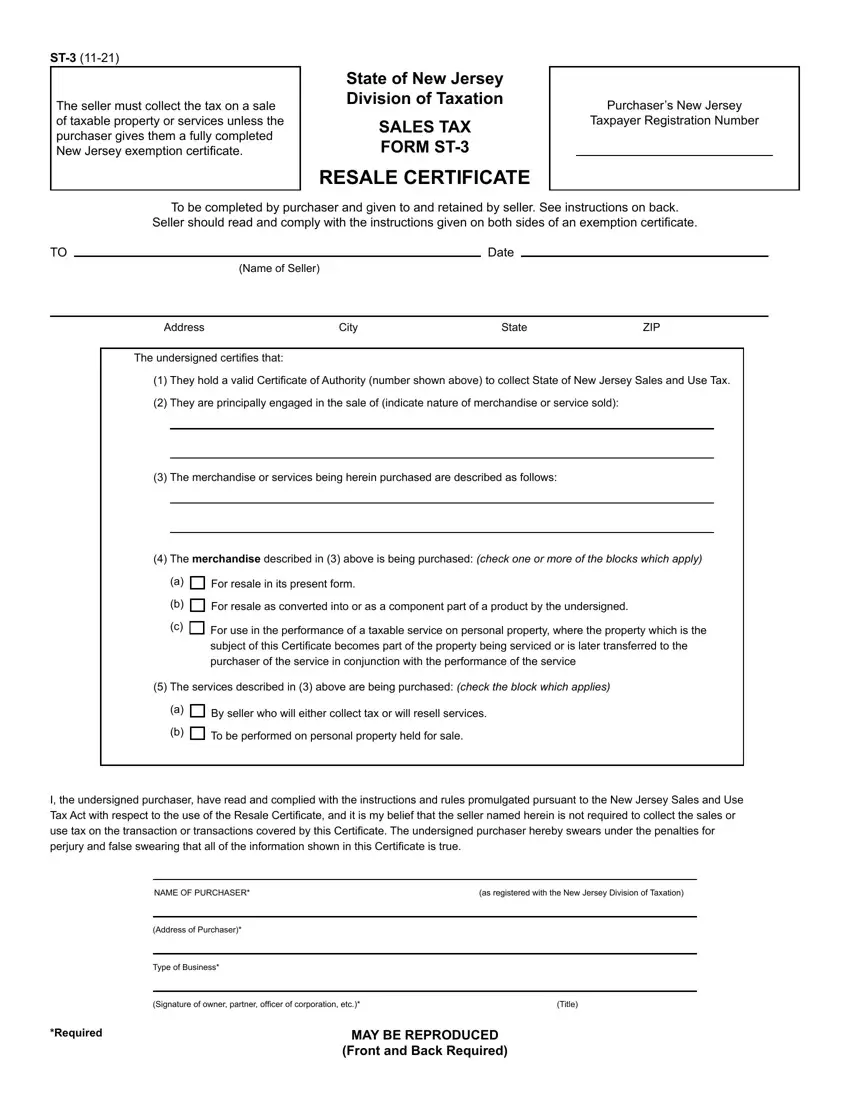

State of New Jersey Division of Taxation SALES TAX FORM ST-3 RESALE CERTIFICATE Purchasers New Jersey Taxpayer Registration Number To be completed by purchaser and given to and retained. Sales and Use Tax. This is your permit to collect Sales Tax and to use Sales Tax exemption certificates.

Tax Sale Certificates are recorded in County Clerks Office. Further additional assignments. The answer is yes but there is an exception as I will explain below.

New jersey tax lien sales 2021. Effective January 1 2018 the New Jersey Sales and Use Tax rate decreases from 6875 to 6625. The New Jersey Supreme Court in In re.

Tax sales are conducted by the tax collector. The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. After the tax sale certificate has been issued the lien holder now has the right to pay any delinquent municipal charges.

As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. The amount of the sale as set forth in the certificate. Ad Fill out a simple online application now and receive yours in under 5 days.

Real Estate and Tax Law. Princeton Office Park LP. Taxations Audit branch to administer the Liquor License Clearance program.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien certificates greater than 10000 a 6 penalty is added. This certificate will furnish your business with a unique sales tax number NJ Sales Tax ID Number. The description below is designed to provide the reader with a brief overview of this procedure.

Complete a New Jersey Sales and Use Tax Registration. This certificate is your authorization from the State of New. However if someone would like to purchase them they must contact the Municipal Tax Assessors office in.

ST-3NR 3-17 State of New Jersey DIVISION OF TAXATION SALES TAX Form ST-3NR RESALE CERTIFICATE FOR NON-NEW JERSEY SELLERS For use ONLY by out-of-state sellers not required to be registered in New Jersey THIS FORM IS NOT VALID UNLESS FULLY COMPLETED. Therefore you can complete the ST-3 resale certificate form by providing your New Jersey Sales Tax Permit Number Taxpayer Registration Number. What is sold is a tax sale certificate a lien on the property.

The ClearanceLicense Verification Unit works with the. The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. Sale of certificate of tax sale liens by municipality.

Taxations Field Investigations Unit. Fast Processing for New Resale Certificate Applications. Methods of sale of certificate of tax sale by municipality.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Sales and Use Tax. Register for a NJ Certificate of Authority Online by filling out and submitting the State Sales Tax Registration form.

Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. The first question that comes to mind is whether New Jersey has a statute of limitations that requires a tax sale certificate holder to file a foreclosure suit or be deemed to have lost the right to do so.

By selling off these tax liens municipalities generate revenue. 545-79 provides a 20 year limitations period for a tax sale. Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges.

Fill out the ST-3 resale certificate form. Due to changes in the New Jersey State Tax Sale Law the tax collector must create the tax sale list 50 days prior to the sale and all charges on that list together with cost of sale must be paid to stay out of sale. State Alcohol Beverage Commission.

Foreclosure right of redemption recording of final judgment. Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Creditor to take property without sale after a judgment of foreclosure.

Third parties and the municipality bid on the tax sale certificates TSC. Tax sale certificate redemption new jersey. 30 rows Sales and Use Tax.

The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA. Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. Tax sale certificates can earn interest of up to 18 per cent depending on the winning percentage bid at the.

Ad Fast Online New Business Tax Exempt Resale Certificate Nj. A foreign corporation must register for Corporation Business Tax if it will have employees or representatives at trade shows in New Jersey to. SU-6 Sales Tax Exemption Administration New Jersey Sales Tax Exemption Certificates Corporation Business Tax Your business activity may require you to register for New Jersey Corporation Business Tax.

You must file a New Jersey Sales and Use Tax Quarterly Return with Form ST-50 every three months even if no tax was collected during that particular quarter. At the conclusion of the sale the highest bidder pays the outstanding. Additional information about.

14B Abandoned Property List in the City of Newark. Exemption Certificates Under New Jersey law some items are exempt from sales and use tax regardless of who buys them or how they are used eg most clothing food food ingredients. Sales subject to current taxes.

Federal Employer Id entification Number FEIN from the IRS or the owners Social Security Number if a sole proprietorship with no employees. Once a tax clearance is approved we send the certificate electronically to the municipal clerk where the license is located. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes.

If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you. Once you complete the online process you will receive a confirmation with all relevant important information within 1-2. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Tax Exempt Resale Certificate Nj. 545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

Gloucester City Tax Sale Information Gloucester City Nj

How To Register For A Sales Tax Permit In New Jersey Taxvalet

St3 Form Nj 2021 Sales Tax Zrivo

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Minnesota Bill Of Sale Template Hennepin County

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

Form St 3 New Jersey Fill Out Printable Pdf Forms Online

Form Gtb 10 Download Fillable Pdf Or Fill Online Application For Tax Clearance Business Assistance And Incentives New Jersey Templateroller

Furniture Bill Of Sale How To Create A Furniture Bill Of Sale Download This Furniture Bill Of Sale Bill Of Sale Template Bill Of Sale Car Business Template

How To Register For A Sales Tax Permit In New Jersey Taxvalet

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Jared Cucci Director Of New Jersey Tax Lien Acquisitions And Servicing Bala Partners Llc Linkedin

New Jersey Division Of Taxation Letter Sample 1

Browse Our Image Of Holding Deposit Form Template Being A Landlord Proposal Letter Receipt Template